Mayhem or Market Shift? What Google Search Data Reveals About Agriculture’s Quietest Month in Nearly Two Decades

May should have been chaos. In Ag & Equipment circles, we call it “Mayhem” for a reason. It’s the crucial month when agriculture dealers and suppliers typically see their biggest revenue push of the year. Farmers are buying, dealers are selling, and search engines are buzzing with equipment queries.

Except this May, the buzz never came…not like we expected.

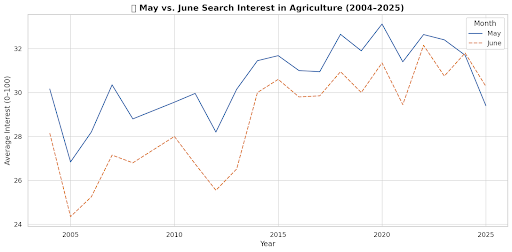

Farm Equipment Search Trends Show Historic May 2025 Decline

After pulling 21 years of Google Trends* data covering the five major ag equipment brands (John Deere, Kubota, Mahindra, New Holland, and Massey Ferguson), one thing became crystal clear: May 2025 recorded the lowest farm equipment search interest since 2006.

The average search interest across all five brands hit just 29.40. That’s even lower than May 2020’s pandemic-disrupted 33.12, and well below the typical decade average of 32.5+. To put this in perspective, May 2023 saw agriculture search interest peak above 35. Two years later, we’re not just seeing a dip; we’re essentially witnessing digital silence across the farm machinery market.

This isn’t about one brand having an off month. When search behavior drops across Deere, Kubota, Mahindra, New Holland, and Massey Ferguson simultaneously, something bigger is happening in the market.

What’s Behind the Low Agriculture Equipment Sales Interest?

The search data can’t tell us why farmers weren’t researching tractors and farm equipment, but anyone working in agricultural equipment sales can connect the dots:

- Farm cash flow pressure: Rising interest rates hit tractor purchases and equipment financing hard

- Equipment inventory uncertainty: Supply chain issues are still creating longer buying cycles for farm machinery

- Agricultural market volatility: When crop prices swing, equipment purchases wait

- Weather delays: Late springs and unpredictable conditions shifted farm equipment buying timing

- Trade policy concerns: Tariff uncertainty makes big agriculture equipment purchases feel risky

These factors didn’t just suppress May farm equipment activity, either. They fundamentally altered when farmers began their tractor and machinery research.

June & July’s Modest Rebound: A Sign of Life

Fortunately, the data indicates a pulse. June 2025 showed renewed farm equipment interest with search trends climbing to 30.28. While still below pre-pandemic peaks, it suggests the buying interest for tractors and other machinery didn’t disappear—it just shifted later in the growing season.

July’s agriculture equipment search data is even more encouraging, currently tracking 6.5% above last year. For an industry built around May momentum, this late-season pickup in searches might signal a post-May “wake-up”, where tractor buying decisions are happening deeper into the growing season.

John Deere vs Kubota: Brand-Specific Search Trends 2025

While overall farm equipment search interest was down, the individual agriculture equipment brand data tells a more nuanced story. John Deere maintained its tractor search volume leadership, but Kubota showed resilience in specific regional farm equipment markets.

Looking at state-level ag & equipment search trends from 2018-2025, Kubota has gained significant ground in states like Texas, Tennessee, and Alabama, markets where it now rivals or exceeds John Deere in search interest. This geographic shift in tractor brand searches reflects broader demographic and agricultural changes happening across the country.

The regional farm equipment search data suggests that while Deere remains dominant in the Midwest and Great Plains, Kubota is gaining share in key growth states—especially in the South and Southeast. The overall agriculture equipment market declined in May, but certain tractor brands and regions showed more stability than others.

What Ag Equipment Search Trends Mean for Dealers

If you felt like May was unusually quiet for tractor sales this year, the farm equipment search data confirms what you already knew. But the June and July ag equipment search rebounds suggest a few things:

Farm equipment buying cycles are stretching longer. Farmers, contractors and homeowners are taking more time to research and compare tractors, which means your digital presence needs to work harder throughout the extended decision window for agriculture equipment purchases.

Regional farm equipment market variations matter more than ever. What works for John Deere marketing in Iowa might not work for Kubota promotion in Texas, and the data shows these regional differences are becoming more pronounced.

Late-season farm equipment urgency is real. The July uptick in ag & equipment searches suggests people are still buying tractors. They’re just compressed into a shorter timeframe, which puts pressure on equipment inventory and service capacity.

Farm Equipment Market Outlook: What’s Next for Agricultural Machinery Sales

This May’s equipment search behavior might be an anomaly, or it could signal a long-term shift in how farmers approach tractor and agricultural equipment purchases. For dealers and manufacturers, this data reveals both challenges and opportunities. Understanding these search patterns gives you an edge in planning inventory, timing marketing campaigns, and allocating resources when farmers are actually ready to purchase.

We’re continuing to track agriculture equipment search data through harvest season to see if the late-season pickup in farm machinery interest sustains or if we’re looking at a very different ag equipment market dynamic going forward.

Why Agriculture Marketing Data Matters More Than Ever

At Root+Beta*, we take pride in staying at the forefront of agriculture. We’ve seen how search behavior data translates directly into equipment sales performance. Our proprietary Doppio® system and demand-gen strategies are built on data like this. We track these exact patterns in real-time, helping ag equipment brands move from reacting to market changes to anticipating them. That’s how you position yourself and your brand as an industry leader.

This kind of ag equipment search analysis is more than just interesting. It’s actionable intelligence that drives better marketing decisions for dealers and manufacturers. While some agencies treat agriculture marketing as just another vertical, at Root+Beta, we’ve built our entire company around understanding how farmers, contractors, and agriculture equipment buyers actually search and purchase.

As a Google Premier Partner focused exclusively on ag & equipment marketing, our strategies go way beyond running campaigns. We build category leadership using performance data, behavioral insights, and strategic creative that speaks directly to equipment buyers.

Get Agriculture Equipment Search Insights for Your Brand

Want to know how your ag equipment brand compares to competitors across specific regions or markets? Root+Beta* offers free, comprehensive digital share-of-search audits for ag brands and dealers, revealing exactly where your machinery marketing stands against the competition.

Our marketing team can show you real-time tractor brand search trends, regional farm equipment market opportunities, and seasonal buying patterns specific to your equipment categories. Whether you’re looking to understand agriculture equipment search behavior in specific states or track farm equipment trends across broader markets, we provide the data-driven insights that turn search patterns into sales growth.

Ready to understand what agriculture & equipment search data means for your business? Connect with our team at Root+Beta for a free brand audit and discover where your farm equipment marketing opportunities really are. Email us at howdy@rootandbeta.com, give us a call at (501) 291-1642, or schedule a meeting with us today.

Connect with the Root+Beta team

*How Google Trends Works

Google Trends tracks the frequency of a term’s searches relative to all other searches over time. It doesn’t show volume but rather interest as a percentage of peak popularity (on a scale of 0 to 100). It’s one of the most powerful, free tools for identifying demand cycles, regional hot spots, and behavioral shifts.

*Why Work with Root+Beta

Root+Beta is 100% agriculture-focused and a 2025 Google Premier Partner. We don’t just run ads; we architect category leadership with performance data, behavioral science, and strategic creative. While others generalize, we specialize—and that makes all the difference.