The agricultural equipment industry has long been considered traditional. But the problem with tradition is that it can mask opportunity. While many brands across North America struggled with declining market share and sluggish digital growth, a large dealer operating across four states wanted to buck the trend.

The market still believed farmers weren’t ready for online transactions. Our data told a different story. Farmers were shopping, searching, and buying—especially from mobile devices. However, friction in checkout, poor mobile design, and limited product visibility held the category’s back.

Backed by our Google Premier Partner access and tools, Root+Beta studied search intent, device behavior, and audience affinities. We discovered that mobile wasn’t just part of the funnel—it was the funnel. Over 70% of traffic came from mobile, and 78% of purchases were from mobile users.

Root+Beta crafted a mobile-first strategy centered on:

We leveraged Search Ads 360, Display & Video 360, and Google’s Merchant Center to maximize visibility. With schema markup, dynamic remarketing, product feed refinement, and performance creative, the brand began showing up in:

We also used first-party data, scroll depth tagging, cart abandonment triggers, and video view history to personalize retargeting and create segmented remarketing audiences. This increased return visits, boosted average order value, and accelerated product velocity.

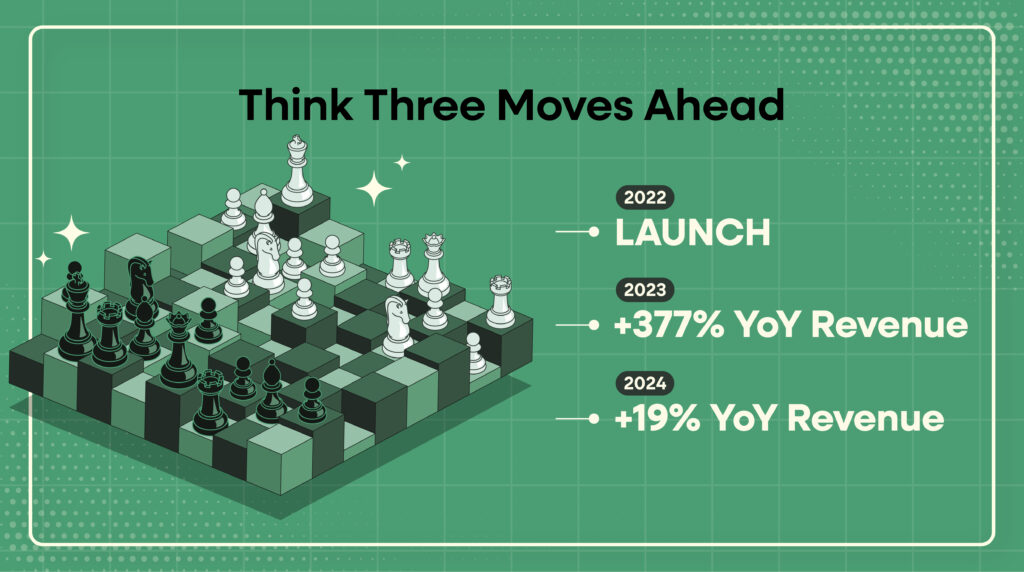

From 2022 through 2024, the brand achieved dramatic revenue growth:

2023 marked a watershed moment where investments in paid media, UX, and product strategy coalesced. By 2024, growth had stabilized at 19%, indicating maturity and strong performance from returning customers. While the broader industry experienced contraction in 2025, this agriculture eCommerce brand expanded and is poised for another record-breaking year in 2026.

Website traffic broke records almost every month, reflecting better visibility across Google’s surfaces and higher on-site engagement. Google Shopping, in particular, served as a demand generator and purchase closer, especially for lower-ticket items such as branded shirts, utility tools, and seasonal feed specials.

Demographics confirmed farmers of all ages are active online. Users 45 and up generated more than 3x the revenue of the 18–34 audience combined, with the 65+ segment outperforming younger groups in key event rate and revenue.

This wasn’t another agriculture portal with no SEO value. It became a true retail destination, setting a new standard for digital sales in agriculture.